Naouri Casino Rallye

Groupe Casino (CO FP) is one of the most overvalued and misunderstood companies we have ever come across. The basic problem with Casino is that its financial statements are literally meaningless to understanding the company’s (poor) health. They do not distinguish between what Casino owns and what it owes. (Spoiler: we estimate Casino’s LTM leverage ratio at 8.9x.)

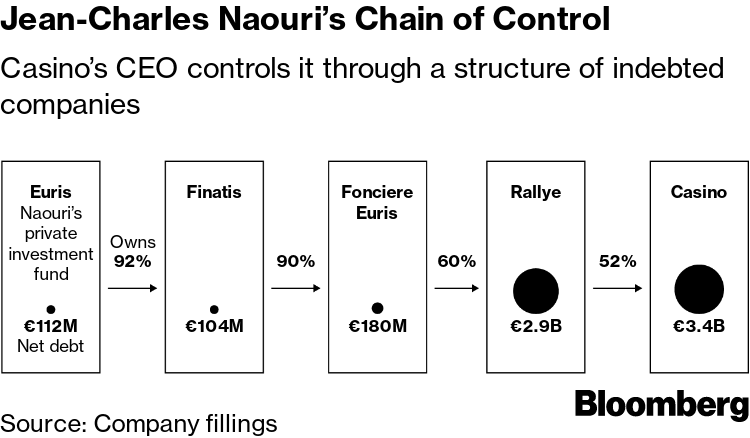

Naouri acquired controlling shares in Casino after it merged with Rallye in 1998. Jean-Charles’s son, Gabriel Naouri, is an entrepreneur and was previously deputy head of international operations of Groupe Casino until 2017. Casino Chairman and Chief Executive Naouri in May placed the retailer's parent companies Rallye, Finatis and Fonciere Euris under protection from creditors in a bid to save the group from collapse.

Casino’s controlling shareholder Jean-Charles Naouri is a genius. He won first prizes in France’s high school Latin and Greek exams, completed his baccalaureate degree at 15, and earned a PhD in math in only one year. Like the geniuses who founded the hedge fund Long-Term Capital Management, which spectacularly collapsed, Mr. Naouri has an affinity for leverage. One would expect Casino to be a relatively boring hypermarket retailer; however, together with its parent, Rallye SA (RAL FP), Casino increasingly resembles a highly levered hedge fund. One example is Casino’s total return swaps on listed equities, which we estimate have a mark-to-market loss of approximately €500 million.

Casino and Rallye are now experiencing their version of a “six sigma event”, with emerging markets (80% of consolidated EBITDA) unwinding, currencies selling-off, and a sharply deteriorating core business. Casino obfuscates these problems by (i) adding complexity to its already convoluted structure and financials, (ii) engaging in financial engineering to improve the optics of its financials, and (iii) by hollowing out the productive value of the businesses in order to keep Rallye from collapsing.

Shares in indebted French supermarket group Casino and its parent Rallye were suspended on Thursday pending a statement, fuelling speculation of a debt restructuring that could weaken the grip of retail kingpin Jean-Charles Naouri. Prior to the suspension, shares in Casino, which is grappling with tough.

Our report peels away many layers of the onion to show that Casino is dangerously leveraged, and is being managed for the very short-term. We explain that Casino’s shares are worth as little as €6.91, and correspondingly, the shares of Rallye are likely going to zero. If Casino trades at our estimated value of €6.91, the recovery on Rallye’s bonds should be about €0.15.

To download the full report (file size: 5.2 MB), check the box to agree with the Terms of Service and then click the “Download Report” button.

- Back in April, we determined that Mr Naouri's crucial tier - Rallye SA - was now in negative equity, as its debt far outweighed the value of its Casino stock and other holdings.

- Finally, Jean-Charles Naouri will propose to the Board of directors of Casino, Guichard Perrachon to submit to the next general meeting of shareholders a resolution in view of the appointment of a.

Terms of Use

The reports on this website have been prepared by either Muddy Waters, LLC (“Muddy Waters Research”) or Muddy Waters Capital LLC (“Muddy Waters Capital”). We refer to Muddy Waters Research and Muddy Waters Capital collectively as “Muddy Waters” and individually these entities are referred to as a “Muddy Waters Entity”. Each report specifies the publisher and owner of that report. All reports are for informational purposes only. Under no circumstances should any of these reports or any information herein be construed as investment advice, or as an offer to sell or the solicitation of an offer to buy any securities or other financial instruments.

Muddy Waters Research is an online research publication that produces due diligence-based reports on publicly traded securities, and Muddy Waters Capital LLC is an investment adviser registered with the U.S. Securities and Exchange Commission. The reports are the property of the applicable Muddy Waters Entity that published that report. This website is owned by Muddy Waters Research. The opinions, information and reports set forth herein are solely attributable to the applicable Muddy Waters Entity and are not attributable to any Muddy Waters Related Person (defined below) (other than the applicable Muddy Waters Entity).

By downloading from, or viewing material on this website, you agree to the following Terms of Use. You agree that use of the research on this website is at your own risk. You (or any person you are acting as agent for) agree to hold harmless Muddy Waters Research, Muddy Waters Capital and its affiliates and related parties, including, but not limited to any principals, officers, directors, employees, members, clients, investors, consultants and agents (collectively, the “Muddy Waters Related Persons”) for any direct or indirect losses (including trading losses) attributable to any information on this website or in a research report. You further agree to do your own research and due diligence before making any investment decision with respect to securities of the issuers covered herein (each, a “Covered Issuer”) or any other financial instruments that reference the Covered Issuer or any securities issued by the Covered Issuer. You represent that you have sufficient investment sophistication to critically assess the information, analysis and opinion on this website. You further agree that you will not communicate the contents of reports and other materials on this site to any other person unless that person has agreed to be bound by these Terms of Use. If you access this website, download or receive the contents of reports or other materials on this website on your own behalf, you agree to and shall be bound by these Terms of Use. If you access this website, download or receive the contents of reports or other materials on this website as an agent for any other person, you are binding your principal to these same Terms of Use.

You should assume that, as of the publication date of a Muddy Waters report, Muddy Waters Related Persons (possibly along with or through its members, partners, affiliates, employees, and/or consultants), Muddy Waters Related Persons clients and/or investors and/or their clients and/or investors have a position (long or short) in one or more of the securities of a Covered Issuer (and/or options, swaps, and other derivatives related to one or more of these securities), and therefore stand to realize significant gains in the event that the prices of either equity or debt securities of a Covered Issuer decline or appreciate. Muddy Waters Research, Muddy Waters Capital and/or the Muddy Waters Related Persons intend to continue transacting in the securities of Covered Issuers for an indefinite period after an initial report on a Covered Person, and such person may be long, short, or neutral at any time hereafter regardless of their initial position and views as stated in the research report published by Muddy Waters Research or Muddy Waters Capital. Neither Muddy Waters Research nor Muddy Waters Capital will update any report or information on its website to reflect changes in positions that may be held by a Muddy Waters Related Person.

This is not an offer to sell or a solicitation of an offer to buy any security. Neither Muddy Waters Research nor any Muddy Waters Related Person (including Muddy Waters Capital) are offering, selling or buying any security to or from any person through this website or reports on this website. Muddy Waters Research is affiliated with Muddy Waters Capital. Muddy Waters Capital is an investment adviser with the U.S. Securities and Exchange Commission and is not registered as investment adviser in any other jurisdiction. Muddy Waters Capital does not render investment advice to anyone unless it has an investment adviser-client relationship with that person evidenced in writing. You understand and agree that Muddy Waters Capital does not have any investment advisory relationship with you or does not owe fiduciary duties to you. Giving investment advice requires knowledge of your financial situation, investment objectives, and risk tolerance, and Muddy Waters Capital has no such knowledge about you.

If you are in the United Kingdom, you confirm that you are accessing research and materials as or on behalf of: (a) an investment professional falling within Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “FPO”); or (b) high net worth entity falling within Article 49 of the FPO (each a “Permitted Recipient”). In relation to the United Kingdom, the research and materials on this website are being issued only to, and are directed only at, persons who are Permitted Recipients and, without prejudice to any other restrictions or warnings set out in these Terms of Use, persons who are not Permitted Recipients must not act or rely on the information contained in any of the research or materials on this website.

The research and reports presented on this website express the opinion of the applicable Muddy Waters Entity only. Reports are based on generally available information, field research, inferences and deductions through the applicable Muddy Waters Entity’s due diligence and analytical process. To the best of the applicable Muddy Waters Entity’s ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources that the applicable Muddy Waters Entity believe to be accurate and reliable, and who are not insiders or connected persons of the Covered Issuers or who may otherwise owe a fiduciary duty, duty of confidentiality or any other duty to the Covered Issuer (directly or indirectly). However, such information is presented “as is,” without warranty of any kind, whether express or implied. With respect to their respective research reports, Muddy Waters Research and Muddy Waters Capital makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any report on this site contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and neither Muddy Waters Research nor Muddy Waters Capital undertakes to update or supplement any reports or any of the information, analysis and opinion contained in them.

In no event shall Muddy Waters Research, Muddy Waters Capital or any Muddy Waters Related Persons be liable for any claims, losses, costs or damages of any kind, including direct, indirect, punitive, exemplary, incidental, special or, consequential damages, arising out of or in any way connected with any information on this website. This limitation of liability applies regardless of any negligence or gross negligence of Muddy Waters Research, Muddy Waters Capital or any Muddy Waters Related Persons. You accept all risks in relying on the information on this website.

You agree that the information on this website is copyrighted, and you therefore agree not to distribute this information (whether the downloaded file, copies / images / reproductions, or the link to these files) in any manner other than by providing the following link: https://www.muddywatersresearch.com/research/. If you have obtained research published by Muddy Waters Research or Muddy Waters Capital in any manner other than by download from that link, you may not read such research without going to that link and agreeing to the Terms of Use. You further agree that any dispute between you and Muddy Waters Research and its affiliates arising from or related to this report and / or the Muddy Waters Research website or viewing the material hereon shall be governed by the laws of the State of California, without regard to any conflict of law provisions. You knowingly and independently agree to submit to the personal and exclusive jurisdiction of the state and federal courts located in San Francisco, California and waive your right to any other jurisdiction or applicable law, given that Muddy Waters Research and its affiliates are based in San Francisco, California. The failure of Muddy Waters Research or Muddy Waters Capital to exercise or enforce any right or provision of these Terms of Use shall not constitute a waiver of this right or provision. You agree that each Muddy Waters Related Person is a third-party beneficiary to these Terms of Use. If any provision of these Terms of Use is found by a court of competent jurisdiction to be invalid, the parties nevertheless agree that the court should endeavor to give effect to the parties’ intentions as reflected in the provision and rule that the other provisions of these Terms of Use remain in full force and effect, in particular as to this governing law and jurisdiction provision. You agree that regardless of any statute or law to the contrary, any claim or cause of action arising out of or related to this website or the material on this website must be filed within one (1) year after the occurrence of the alleged harm that gave rise to such claim or cause of action, or such claim or cause of action be forever barred.

| Born | 8 March 1949 (age 71) Annaba, Algeria |

|---|---|

| Nationality | French |

| Education | École Normale Supérieure Harvard University ÉNA |

| Occupation | Businessman |

| Children | Gabriel Naouri |

| Relatives | Jean-Yves Naouri(brother) |

Jean-Charles Naouri (born March 8, 1949 in Bône (now Annaba), Algeria) is a French businessman. He is Chairman, Chief Executive Officer and controlling shareholder of Groupe Casino.[1]

Education[edit]

Naouri received his baccalaureat degree at only 15 years old. He then studied in classes préparatoires at the Lycée Louis-le-Grand before entering the École Normale Supérieure in 1967. He also attended Harvard University, before returning in France and completing a PhD in Mathematics in only one year. He is also an alumnus of the Ecole Nationale d’Administration (1974-1976).[2]

Early career[edit]

Civil servant[edit]

After graduating from ENA in 1976, Jean-Charles Naouri joined the Inspection générale des finances (France), the auditing and supervisory body of the French Administration. From 1982 to 1986, he served as chief of staff for Pierre Bérégovoy, both at the Ministry of Social Affairs and National Solidarity and the Ministry of Economy, Finance and Budget.[3] During this period, he was the architect of the reforms implemented in the French financial markets, which included the creation of the MATIF futures and MONEP options markets and the introduction of certificates of deposit and commercial paper. In particular, he helped drive the financial market liberalization with measures to ease currency controls and eliminate credit restrictions.

Rothschild & Cie Banque[edit]

In 1987, Jean-Charles Naouri left government service and joined Rothschild & Cie Banque as Managing Partner.[4] Around the same time, he established his own investment fund, Euris, which acquired minority equity investments in industrial companies, while increasing its investment capabilities.

Global retailing[edit]

Rallye[edit]

In the early 1990s, Jean-Charles Naouri shifted his investment strategy from opportunistic to acquiring strategic stakes. As part of this new strategy, in 1991 he acquired the Brittany-based retailer Rallye, which at the time was facing serious cash flow issues/challenges. Convinced of the future potential for retailing and the benefits of combining the two companies, in 1992 he engineered a merger of Rallye with Groupe Casino, thereby becoming Groupe Casino's largest shareholder.

Groupe Casino[edit]

In 1997, a hostile takeover bid for Groupe Casino by rival retailer Promodès[5] was thwarted by the successful counter offer [6] from Jean-Charles Naouri, the Guichard family and Casino management, thereby maintaining the Group's independence.

In March 2005, Jean-Charles Naouri became Chairman and Chief Executive Officer of Casino Group,[7] leading a substantial transformation of the retailer's profile by disposing of underperforming business segments in Poland, the United States, Taiwan and the Netherlands and strengthening the Group's presence in fast-growing markets. This made Casino the leading food retailer in South America (especially Brazil and Colombia), the Indian Ocean and Vietnam and the second largest in Thailand.

In France, Jean-Charles Naouri has refocused French operations in the convenience format segment, Groupe Casino's core business, and also positioned Casino in the discount segment by developing the Leader Price chain and the Cdiscount e-commerce website acquired in 2000.

Naouri Casino Rallye Bingo

In 2012, Groupe Casino acquired a controlling interest in Brazilian retailer Pão de Açúcar, the country's largest private-sector employer.[8] The Group also purchased the 50% of French retailer Monoprix, which it did not already own, becoming the sole shareholder.[9]

Social responsibility commitment[edit]

In addition to his business activities, Jean-Charles Naouri is also the founder of the Euris Foundation, which he created in 2000. Each year, the Foundation grants 40 scholarships to promising high school graduates from impoverished neighbourhoods in France.[10]

He is also Vice Chairman of the Groupe Casino corporate foundation, which he founded in 2009 to improve access to culture and knowledge for children who are disadvantaged or suffering from illness.In addition, he is Honorary Chairman and Trustee of Ecole Normale Supérieure's Institut d’Expertise et de Prospective,[11] which is responsible for developing ties between the school and the corporate world.

In June 2013, Jean-Charles Naouri was appointed by France's Ministry of Foreign Affairs to be a special representative for Economic relations with Brazil.[12]

Positions[edit]

- Chairman and Chief Executive Officer of Groupe Casino, a listed company

- Chairman of the Board of Cnova N.V.

- Chairman and Chief Executive Officer of Euris

- Chairman of Rallye, a listed company

- Chairman of the Board of Directors of Companhia Brasileira de Distribuicao (CBD), a listed company

- Vice-Chairman of the Casino Group Corporate Foundation

- CEO of Casino Finance

- Chairman of the Euris Foundation

Naouri Casino Rallye Entertainment

Other positions[edit]

- Board Member of Financière Marc de Lacharrière (FIMALAC)

- Member of the Advisory Committee of Banque de France

- Chairman of Association Promotion des Talents, a non-profit organisation

- Honorary Chairman and Director of Institut d’Expertise et de Prospective (Ecole Normale Supérieure)

Net worth[edit]

In 2015, Jean-Charles Naouri was ranked by Forbes Magazine as being worth $1.2 billion dollars. [13]

References[edit]

- ^Jean Charles Naouri - Executive profile, Bloomberg Businessweek]

- ^Jean-Charles Naouri - Brief biography, Reuters

- ^Casino indiser : Jean-Charles Naouri, Macroaxis

- ^Bookish Frenchman becomes Brazil retail kingpin, Chicago Tribune,June 21, 2013

- ^French Grocery Chain Raises Hostile Bid, the New York Times, September 26, 1997

- ^Casino Guichard-Perrachon S.A. History, Funding Universe

- ^Jean-Charles Naouri becomes CEO of Casino, Retail Analysis, March 24, 2005

- ^Casino to Become Sole Controller of Brazil’s Pao de Acucar, Bloomberg, May 15, 2012

- ^Dean Best, Casino's Monoprix acquisition cleared, Just Food, July 10, 2013

- ^L'excellence des lycéens défavorisés récompensée, Le Figaro, October 22, 2010

- ^Jean-Charles Naouri est nommé président de l'Institut d'expertise et de prospective de l'Ecole normale supérieure, Les Echos, January 22, 2001

- ^Jean-Charles Naouri appointed special representative for economic relations with Brazil, International supermarket news, August 21, 2013

- ^https://www.forbes.com/profile/jean-charles-naouri/#120ea9854bd9